In the world of financial planning, annuities play a crucial role in providing steady income during retirement. Centerpoint annuities, in particular, have gained popularity for their reliability and flexibility. However, a question that often arises is: what happens to a Centerpoint annuity after the annuitant’s death? This comprehensive guide will walk you through the processes, options, and considerations that come into play when a Centerpoint annuity holder passes away.

Introduction

Centerpoint annuities are financial products designed to provide a steady stream of income, typically during retirement. These annuities are contracts between an individual and Centerpoint, where the individual makes either a lump sum payment or a series of payments in exchange for future periodic payments. While these products are excellent for ensuring financial stability during one’s lifetime, it’s crucial to understand what happens to them after death.

The post-death process for Centerpoint annuities can significantly impact beneficiaries and estate planning. Therefore, having a clear understanding of these procedures is essential for both annuity holders and their potential beneficiaries.

Types of Centerpoint Annuities

Before delving into the post-death processes, it’s important to understand the different types of Centerpoint annuities, as the type of annuity can influence what happens after the annuitant’s death.

Single Life Annuities

These annuities provide payments for the duration of the annuitant’s life. Once the annuitant passes away, the payments typically cease, unless there are specific provisions in place.

Joint and Survivor Annuities

These annuities continue to make payments as long as either the annuitant or their designated survivor (usually a spouse) is alive. The payments may be reduced after the first death, depending on the terms of the contract.

Period Certain Annuities

These annuities guarantee payments for a specific period, regardless of whether the annuitant is alive. If the annuitant dies before the period ends, the remaining payments go to the designated beneficiary.

Beneficiary Designations

One of the most critical aspects of managing what happens to a Centerpoint annuity after death is the beneficiary designation. The beneficiary is the person or entity who will receive the annuity’s death benefit or continuing payments after the annuitant’s passing.

Primary vs. Contingent Beneficiaries

- Primary beneficiaries are first in line to receive the annuity’s death benefit.

- Contingent beneficiaries receive the benefit if the primary beneficiary is deceased or unable to claim it.

Importance of Keeping Designations Up to Date

Life changes such as marriages, divorces, births, or deaths in the family can affect who you want to receive your annuity benefits. Regularly reviewing and updating your beneficiary designations ensures your wishes are accurately reflected.

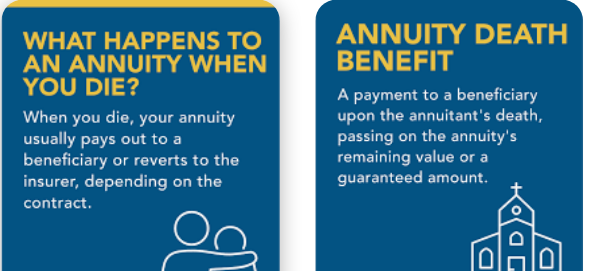

Death Benefit Options

When a Centerpoint annuity holder passes away, beneficiaries typically have several options for receiving the death benefit. The specific options available may depend on the type of annuity and the contract terms.

Lump-sum Payment

Beneficiaries can choose to receive the entire value of the annuity as a single payment. This option provides immediate access to the full benefit but may have significant tax implications.

Continuation of Payments

Some annuities allow beneficiaries to continue receiving payments based on the original contract terms. This can provide a steady income stream over time.

Five-year Rule

For non-spouse beneficiaries of qualified annuities, the five-year rule requires that the entire annuity be distributed within five years of the annuitant’s death. This option provides some flexibility in timing distributions while ensuring the account is fully paid out within a specified period.

Taxation of Death Benefits

Understanding the tax implications of inheriting a Centerpoint annuity is crucial for beneficiaries to make informed decisions about how to receive the death benefit.

Inherited Annuity Tax Implications

The tax treatment of inherited annuities can be complex and depends on several factors, including:

- Whether the annuity was qualified (funded with pre-tax dollars) or non-qualified (funded with after-tax dollars)

- The relationship between the beneficiary and the deceased annuitant

- How the beneficiary chooses to receive the death benefit

Differences Between Qualified and Non-Qualified Annuities

- Qualified annuities, such as those held in IRAs or 401(k)s, are typically subject to income tax on the entire distribution.

- For non-qualified annuities, only the earnings portion of the distribution is taxable, as the principal has already been taxed.

Probate Process and Annuities

One advantage of Centerpoint annuities is that they typically avoid the probate process, which can be time-consuming and costly for other assets.

How Annuities Typically Avoid Probate

Annuities usually pass directly to the named beneficiary, bypassing the probate process. This allows for a quicker and more private transfer of assets.

Exceptions to Probate Avoidance

In some cases, an annuity may become subject to probate:

- If the named beneficiary predeceases the annuitant and no contingent beneficiary is named

- If the estate is named as the beneficiary

Steps for Beneficiaries to Claim Benefits

When a Centerpoint annuity holder passes away, beneficiaries need to take specific steps to claim their benefits.

Notifying Centerpoint of the Annuitant’s Death

The first step is to inform Centerpoint of the annuitant’s passing. This typically involves contacting their customer service department and providing basic information about the deceased and the policy.

Required Documentation

Beneficiaries will need to submit several documents to process the claim, which may include:

- Death certificate of the annuitant

- Proof of beneficiary identity

- Completed claim forms provided by Centerpoint

Choosing a Payout Option

After submitting the necessary documentation, beneficiaries will need to decide how they want to receive the death benefit, considering the options discussed earlier.

Special Considerations

Several special considerations can affect what happens to a Centerpoint annuity after death.

Spousal Continuation Option

Many annuities offer a spousal continuation option, allowing a surviving spouse to step into the deceased spouse’s role as the annuity owner. This can provide continued income and potentially favorable tax treatment.

Impact on Estate Taxes

While annuities generally avoid probate, their value may still be included in the deceased’s estate for estate tax purposes. This is an important consideration for high-net-worth individuals.

Creditor Protection for Beneficiaries

In some states, inherited annuities may offer a level of protection from the beneficiary’s creditors. Understanding these protections can be crucial for beneficiaries facing financial difficulties.

Common Mistakes to Avoid

When dealing with Centerpoint annuities after death, several common pitfalls should be avoided:

Failing to Name a Beneficiary

Not naming a beneficiary or keeping beneficiary designations outdated can lead to unintended consequences, potentially forcing the annuity through probate or to unintended recipients.

Overlooking Tax Implications

Failing to consider the tax consequences of different payout options can result in unexpected tax burdens for beneficiaries.

Misunderstanding Payout Options

Not fully understanding the available payout options can lead to suboptimal decisions that may not align with the beneficiary’s financial needs or goals.

Conclusion

Understanding what happens to a Centerpoint annuity after death is crucial for both annuity holders and their beneficiaries. By being aware of the types of annuities, beneficiary designations, death benefit options, tax implications, and claim processes, you can ensure that your financial legacy is managed according to your wishes and that your beneficiaries are well-prepared to handle the inheritance.

Remember that while this guide provides a comprehensive overview, annuity contracts can vary, and individual circumstances differ. It’s always advisable to consult with financial advisors, tax professionals, and legal experts to ensure you’re making the best decisions for your unique situation.

By taking the time to understand and properly manage your Centerpoint annuity, you can provide financial security for your loved ones even after you’re gone, creating a lasting legacy that extends beyond your lifetime.

[Previous content remains the same]

Frequently Asked Questions (FAQs)

To further clarify some common questions about what happens to Centerpoint annuities after death, here are some frequently asked questions and their answers:

Q1: Can I change the beneficiary of my Centerpoint annuity?

A: Yes, in most cases, you can change the beneficiary of your Centerpoint annuity at any time while you’re alive. However, some annuities may have restrictions, especially if they’re irrevocable or if you’ve already started receiving payments. Contact Centerpoint or check your policy documents for specific instructions on changing beneficiaries.

Q2: What happens if I don’t name a beneficiary for my Centerpoint annuity?

A: If you don’t name a beneficiary, or if your named beneficiaries have predeceased you, the annuity proceeds will typically be paid to your estate. This means the annuity will likely go through probate, which can be a time-consuming and potentially costly process. It’s always best to name at least one primary and one contingent beneficiary to avoid this situation.

Q3: Are the death benefits from a Centerpoint annuity taxable?

A: The taxation of annuity death benefits depends on several factors, including whether the annuity was qualified or non-qualified and how the beneficiary chooses to receive the payments. Generally, for non-qualified annuities, only the earnings portion is taxable to the beneficiary. For qualified annuities, the entire distribution is typically taxable. Beneficiaries should consult with a tax professional to understand their specific tax obligations.

Q4: Can a trust be named as a beneficiary of a Centerpoint annuity?

A: Yes, you can name a trust as a beneficiary of your Centerpoint annuity. This can be useful for estate planning purposes, especially if you want to control how and when the annuity proceeds are distributed. However, naming a trust as beneficiary can have complex tax implications, so it’s advisable to consult with an estate planning attorney or financial advisor before making this decision.

Q5: How long do beneficiaries have to claim the death benefit from a Centerpoint annuity?

A: While there’s no strict universal deadline, it’s generally best for beneficiaries to file a claim as soon as possible after the annuitant’s death. Delaying the claim could result in missed opportunities for tax-advantaged distribution options. Additionally, some states have laws requiring insurance companies to turn over unclaimed benefits to the state after a certain period. Check with Centerpoint for any specific timeframes they may have for claiming benefits.

Q6: What if the annuitant dies during the accumulation phase of a deferred annuity?

A: If the annuitant dies during the accumulation phase of a deferred annuity (before payments have begun), the beneficiary typically receives the greater of either the account value or the minimum guaranteed death benefit specified in the contract. The exact amount and payout options will depend on the specific terms of the annuity contract.

Q7: Can a beneficiary continue the annuity contract instead of receiving a lump sum?

A: In many cases, yes. Beneficiaries often have the option to continue the annuity contract, especially if they are the spouse of the deceased annuitant. This is sometimes referred to as a “spousal continuation.” Non-spouse beneficiaries may have the option to annuitize the death benefit or take distributions over their life expectancy, depending on the type of annuity and contract terms.

Q8: What happens to a joint and survivor annuity when one annuitant dies?

A: In a joint and survivor annuity, payments typically continue for as long as either annuitant is alive. When one annuitant dies, the payments usually continue to the surviving annuitant, although the amount may be reduced depending on the terms of the contract. For example, a 100% joint and survivor annuity would continue paying the same amount, while a 50% joint and survivor annuity would reduce to 50% of the original payment amount after the first death.

Q9: Are there any special considerations for beneficiaries who are minors?

A: Yes, if a beneficiary is a minor, special considerations apply. Insurance companies generally won’t pay death benefits directly to minors. Instead, a court-appointed guardian, a trust, or a custodial account under the Uniform Transfers to Minors Act (UTMA) may need to be established to manage the funds until the minor reaches the age of majority.

Q10: Can creditors of the deceased annuitant claim the death benefit?

A: In most cases, annuity death benefits pass directly to the named beneficiaries and are protected from the deceased annuitant’s creditors. However, if the annuity is paid to the estate (due to lack of a named beneficiary, for example), it could potentially be subject to creditors’ claims. Additionally, if the purchase of the annuity was deemed a fraudulent transfer to avoid creditors, it could potentially be challenged.

Remember, while these FAQs provide general information, annuity contracts can vary, and individual circumstances differ. Always consult with financial and legal professionals for advice tailored to your specific situation.